Laurel Ridge Community College participates in the William D. Ford Federal Direct Loan Program, offered through the Department of Education.

- Federal Stafford loans are monies that a student borrows.

- Federal Direct PLUS loans are monies that a parent borrows to assist their undergraduate student. Both loans are financial obligations that must be repaid with interest.

Federal Education loans offer benefits not provided by private/alternative loans:

- Lower interest rates

- Longer repayment terms

- Deferment and Forbearance options

- Early loan forgiveness for graduates working in public service

Please Note: Laurel Ridge CC does not automatically post loans, you must complete all the required steps to request one.

For the Loan Request Form & learn more about Stafford & PLUS Loans click the menus below:

Apply for a Federal Stafford Loan

Students

Read through all the information below, the Loan Request Form is at the bottom.

Federal Stafford Loans are intended to help students and families offset the rising cost of college tuition and appropriate counseling must be completed prior to the certification of a Federal Stafford Loan. Students may not borrow more than the cost of their education minus other financial aid awarded them. Federal Stafford Loans are not to be used as a mechanism for securing enrollment for a student who files their FAFSA late (July 1st-Priority Filing Date). A student must have a payment method in place to pay for classes at the time tuition is due.

Requirements to Qualify:

- Completed FAFSA on file with Laurel Ridge CC

- Must not be defaulted on prior loans

- Must not be maxed out on lifetime amount.

- Enrolled in at least 6 financial aid eligible credits.

- Must be meeting Satisfactory Academic Progress (SAP)

- Complete all Steps to Apply(below)

- Complete Exit Loan Counseling Session upon graduation or withdraw.

- Repayment begins six months after a student leaves school because of graduation, other reasons, or drops below half-time level.

The Financial Aid Office must approve all federal loans and reserves the right to refuse loan applications due to academic deficiency or evidence that a student may have difficulty managing loan debt.

Types of Stafford Loans:

-

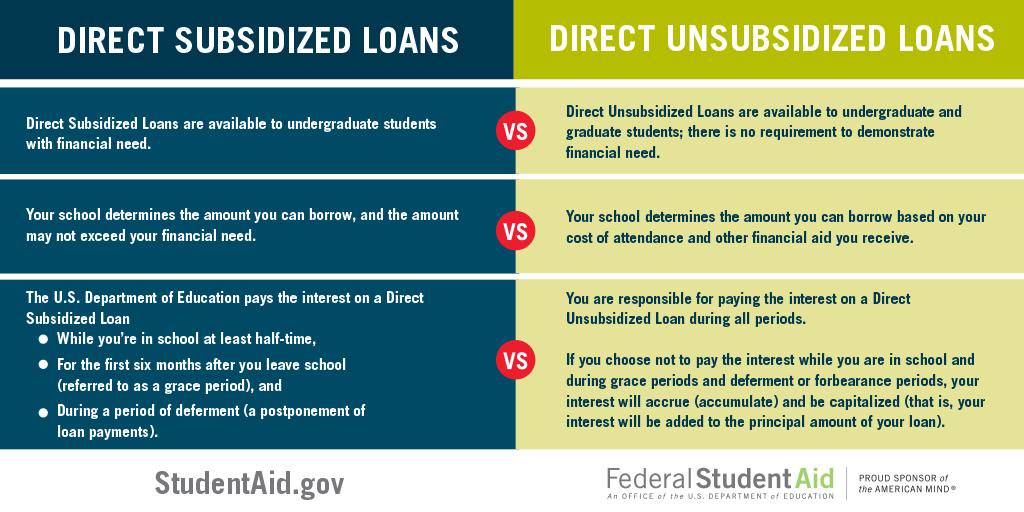

Direct Subsidized Loans are loans made to eligible undergraduate students who demonstrate financial need to help cover the costs of higher education at a college or career school. This means the U.S. Department of Education will pay the interest charges on this type of loan as long as the student is enrolled at least half-time (six or more credits) and during a six-month period following enrollment (grace period) as well as during periods of approved deferment. At the end of the grace period, repayment of the loan will begin and interest begins to accrue to the student borrower. *150% Direct Loan Interest Subsidy Limit Law*

-

Direct Unsubsidized Loans are loans made to eligible undergraduate, graduate, and professional students, but eligibility is not based on financial need.

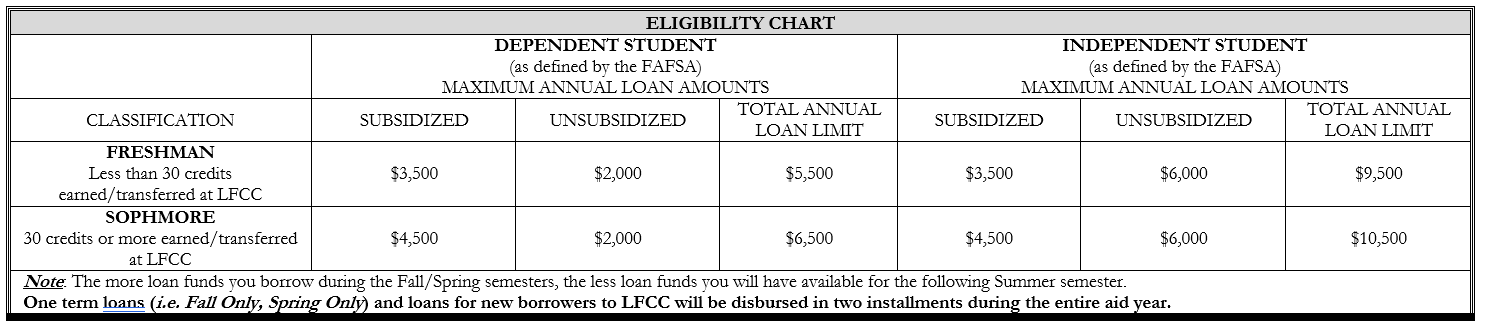

Loan Amount Eligibility:

Determining Amount to Request:

Cost of tuition(Current Tuition & Fees)

+ Textbooks(if you need them. Not sure? Use Bookstore website.)

+ Living expenses (if you have any)

+ Loan Fee (See Loan Request Form Pg2)

Loan Amount

Steps to Apply:

- Complete the Free Application for Federal Student Aid (FAFSA) prior to requesting a Federal Direct Student loan.

- Complete the Master Promissory Note (MPN) for Undergraduates. Complete once, good for 10 years at Laurel Ridge.

- Complete Entrance Counseling (EC). This must be completed every year.

- Complete the Federal Direct Loan Request Form(below) then return to the Financial Aid Office.

2023-24 Federal Direct Loan Request Form

Need to Adjust your Loan? If you need to increase, decrease, or cancel your student loan, please complete and return the Loan Adjustment Form to the Financial Aid Office.

Apply for a Federal Direct PLUS Loan

Parents

2023-24 Federal Parent PLUS Loan Request Form

The Federal Direct PLUS Loan program is a non-need-based source of loan funds for the parent(s) of dependent students. Federal Direct PLUS Loans may be used in conjunction with Federal Direct Stafford Loans.

Direct PLUS Loans are loans made to graduate or professional students and parents of dependent undergraduate students to help pay for education expenses not covered by other financial aid. Eligibility is not based on financial need, but a credit check is required. Borrowers who have an adverse credit history must meet additional requirements to qualify.

Each year, parents of dependent students may borrow an amount not to exceed the cost of attendance less any financial aid (including Federal Direct Stafford Loans).

- A Master Promissory Note is required.

Repayment begins 60 days after the final disbursement is made unless the parent borrower makes other arrangements with their lender to defer repayment. The Federal Direct PLUS Loan on the undergraduate level is only available to parents.* Guardians are ineligible. A credit check is performed on all parental borrowers, and pre-approval is required.

*An eligible parent is defined as the biological or adoptive parent of an undergraduate student. In some cases, a step-parent may be eligible to apply for a PLUS loan. While the custodial parent completes the FAFSA form, a non-custodial parent may be the parent who applies for the PLUS loan. However, the amount eligible to borrow will be based off of the custodial parent’s FAFSA form results.

Federal PLUS Loans are not to be used as a mechanism for securing enrollment for a student who files their FAFSA late (July 1st-Priority Filing Date). A student must have a payment method in place to pay for classes at the time tuition is due.

PLEASE NOTE: This loan is in the parent’s name and the parent will be responsible for repayment of the loan. The loan cannot be transferred to the student.

Need to Adjust your Loan? If you need to increase, decrease, or cancel your student loan, please complete and return the Loan Adjustment Form to the Financial Aid Office.

Appeal to Apply for Federal Loans without Parent Information

This appeal is used when you have indicated your parent(s) cannot and/or will not provide their financial information for completion of your Free Application for Federal Student Aid (FAFSA).

Although the U.S. Department of Education allows a student to indicate a parent’s refusal to provide this information, the student can only exercise this option if supporting documentation is submitted to substantiate this claim. This appeal form provides guidelines for the process of requesting a review of your situation. The burden of collecting, reviewing, and making a ruling on the claim is placed on each individual student aid office. All appeals will be considered on a case-by-case basis, and the reason for the decision must be documented in the student’s file. The decision of the financial aid office is final and cannot be appealed to the U.S. Department of Education.

As a Dependent Student, you qualify for a maximum of $5,500 for the year or $2,750 per semester. You can request whatever about you need up to the max, but we strongly encourage you to keep it on to what you need—if you have the ability to pay for books out of pocket then you can use the ISBNs from the Bookstore website to possibly get them cheaper elsewhere. Below is our suggested calculation for determining how much to request:

Determining Amount to Request:

Cost of tuition(Current Tuition & Fees)

+ Textbooks(if you need them. Not sure? Use Bookstore website.)

+ Living expenses (if you have any)

+ Loan Fee (See Loan Request Form Pg2)

Loan Amount

In order to get the loan in place, you will need to complete the following steps:

- Complete the Master Promissory Note(MPN) for Undergraduates. The MPN is your agreement to re-pay the loans when required.

- Complete Entrance Counseling(EC). Takes about 30 minutes to complete, just to make sure you understand how loans work.

- Complete the Federal Direct Loan Request Form(Click Apply for Federal Direct Loan above then scroll to the bottom). This is where you tell us the amount you are requesting and for what specific semester/year.

- Complete the Loan Appeal without Parent Info (23-24)

- A statement signed and dated from one or both of the student’s parents specifically stating that the parent(s):

- Have ended financial support to the student, and;

- They refuse to provide financial support to the student during the award year; and

- They refuse to complete the parental section of the student’s FAFSA form. (The parent is not required to provide a reason for refusing to complete the FAFSA).

- The student’s name, date of birth and student ID number must be provided in the statement.

Submit the Loan Request Form, Loan Appeal Form, and signed statement to [email protected] for processing. Please monitor your Message Center for an update once processed.

Other Helpful Direct Student Loan Program Links

LOAN COUNSELING (REQUIRED):

Other Helpful Direct Student Loan Program Links:

- FAFSA

- Federal Student Aid ID

- General Information

- Budget Calculator: Use this to get an idea of your college expenses.

- National Student Loan Data System

- Servicing Information

- Account Information

- Repayment Plans & Calculator

- Consolidation Information

- Entrance Counseling Walk-through

- Master Promissory Note Walk-through

Have other questions? Contact the Financial Aid Office